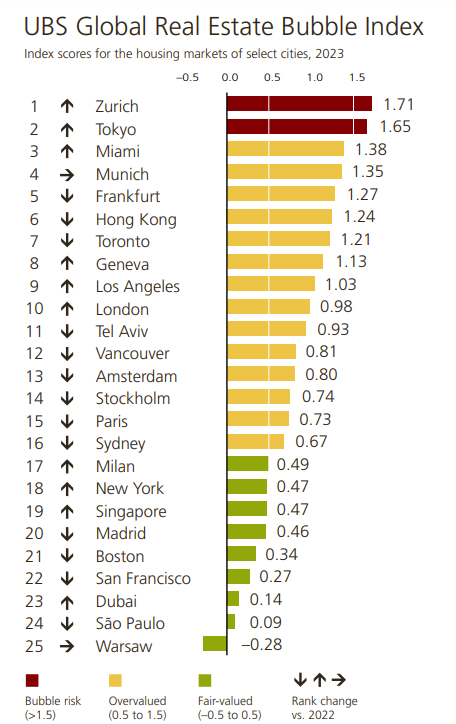

UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland. Every year it publishes a report called “UBS Global Real Estate Bubble Index” where it analyzes real estate performance in major cities around the world: in which cities property prices and valuations have fallen the most, where (further) corrections are imminent, and where price increases are continuing or could happen in the future.

A “bubble” is a significant and persistent mispricing of an asset, the presence of which cannot be established unless it explodes. But patterns of excesses in the real estate market can be seen in historical data. Typical indicators include imbalances in the real economy, such excessive lending and construction activity, and a decoupling of prices from local earnings and rents. Based on these kinds of tendencies, the UBS Global Real Estate Bubble Index estimates the likelihood of a property bubble.

According to the Index, Dubai takes 23rd place out of 25 analyzed cities and is fair-valued staying firmly in the green zone.

The index score is a weighted average of the following five standardized city sub-indices: price-to-income and price-torent ratios (fundamental valuation), change in mortgage-toGDP ratio and change in construction-to-GDP ratio (economic distortion), and city-to-country price ratio.

Read the full report https://www.ubs.com/global/en/wealth-management/insights/2023/global-real-estate-bubble-index.html